The UK's banking sector is potentially facing a new financial dilemma reminiscent of past mis-selling scandals, this time involving car loans. According to estimates by the Royal Bank of Canada (RBC), the banking industry might face a bill of up to £10 billion. This situation arises from the Financial Conduct Authority's (FCA) investigation into auto lending practices, particularly focusing on the transparency of commission payments in dealership deals.

For decades, major lenders like Barclays Plc, Lloyds Banking Group Plc, and Banco Santander SA's UK arm have profited from funding car purchases. The FCA's current probe is centered on whether customers were adequately informed about the commissions paid to dealerships. This scrutiny follows a series of orders issued by the regulator for Section 166 reviews, which involve bringing in external experts to examine and report on a firm's practices.

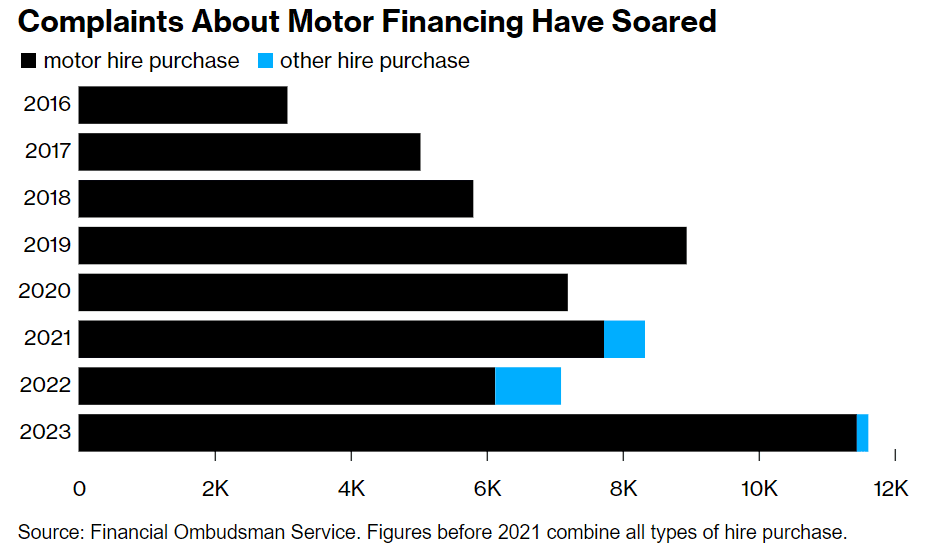

The practice in question, known as the "overage," allows dealers to earn extra by increasing the interest rate on a car loan, often without the consumer's knowledge. The Financial Ombudsman Service, handling customer complaints, has already led to some refunds following test cases.

This situation has already impacted the market, with shares in several banks, including Close Brothers Group Plc, experiencing significant drops. The FCA has put a temporary hold on new complaints while it finalizes its approach to resolving the issue.

The concern over car finance practices is not new. The FCA had previously raised alarms about the increasing use of personal contract purchases in car sales, and three years ago, it banned commissions that incentivized higher borrowing costs for customers.

Lloyds Banking Group, the largest provider of auto finance in the UK, is reviewing the Financial Ombudsman Service's decision and preparing for the FCA's review. Barclays, no longer offering car financing since 2019, is working to resolve historic complaints related to these loans. Santander UK has expressed its support for the FCA's intervention, seeking clarity for both customers and finance firms.

The situation has drawn comparisons to the payment protection insurance (PPI) mis-selling scandal, which cost the banking industry over £38 billion in compensation. Martin Lewis, a well-known consumer rights activist, highlighted the potential scale of compensation, which could involve interest on loans, commissions, or even the entire loan amount.

Analysts from RBC have described the potential impact on the banking sector as significant, while others have criticized these predictions. Nevertheless, this unfolding situation underscores the need for more transparent and fair financial practices in the UK's banking and auto finance sectors.