Vehicle Excise Duty, also known as road tax, is among the skyrocketing costs this month

Life has just got more expensive this week with national insurance, air passenger duty, and even the cost of first and second class stamps, all increasing in cost.

With energy bills rising an average of 54% earlier this month, and the cost of food increasing, people are struggling to afford modern basics we've grown used to. Cars account for some of the highest household costs, but for many, they're the means of earning enough to keep pace with spiraling costs.

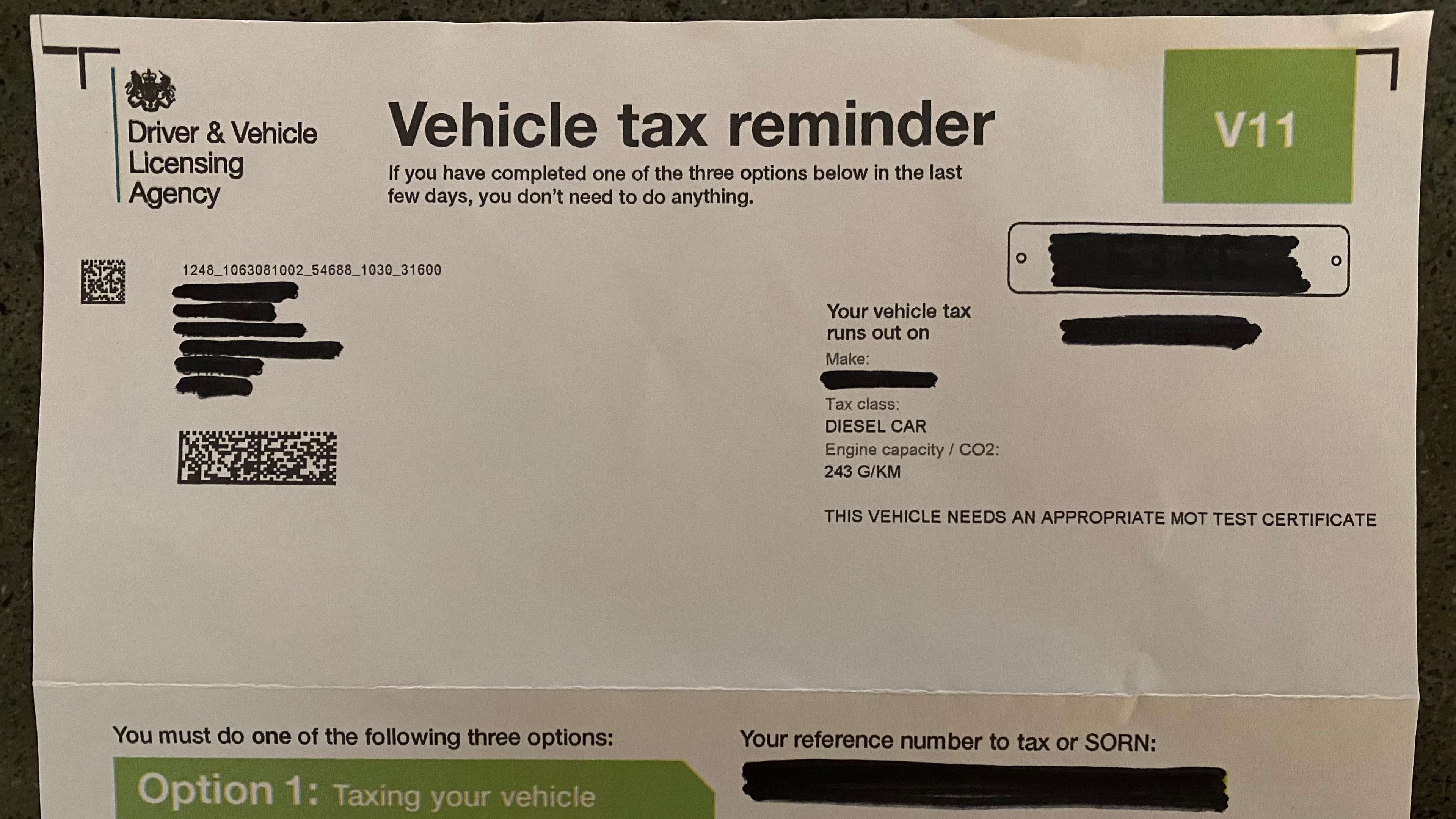

Running a car is among the skyrocketing costs this April, with Vehicle Excise Duty (VED) - more commonly known as car or road tax - now more expensive for most drivers increasing from 1 April 2022. The duty rose in line with the Retail Price Index measure of inflation, but the increase varies between vehicles, depending on their emission levels.

The duty rise is expected to have no impact on its budget, but the government hopes the change will "encourage the uptake of lower emission vehicles". People with more environmentally friendly vehicles face smaller rises. The car tax stands at zero for cars that emit no carbon dioxide (CO2), while the most polluting cars "pay over £2,000 at first registration and a flat rate thereafter".

Vehicles with higher levels of emissions face the same increase in the standard rate, but pay a higher first year rate, which increases in increments parallel with emissions. The regulation means that if your emissions are between 1 and 50g of CO2 per kilometre, your standard rate of car tax will increase from £155 to £165, although the first year rate will be £10.

Here is a breakdown of the new VED rates based on CO2 emmissions:

- 51 and 75g of CO2 per km : standard rate will increase from £155 to £165, while your first year rate will stay at £25.

- 76 and 90g of CO2 per km : standard rate will increase from £155 to £165, while your first year rate will increase from £115 to £120.

- 91 and 100g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £140 to £150.

- 101 and 110g of CO2 per km : standard rate will increase from £155 to £165 and the first year rate will increase from £160 to £170.

- 111 and 130g of CO2 per km : standard rate will increase from £155 to £165, while your first year rate will rise from £180 to £190.

- 131 and 150g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £220 to £230.

- 151 and 170g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £555 to £585.

- 171 and 190g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £895 to £945.

- 191 and 225g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £1,335 to £1,420.

- 226 and 255g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £1,895 to £2,015.

- Over 256g of CO2 per km : standard rate will increase from £155 to £165 and your first year rate will rise from £2,245 to £2,365.

Do any car owners pay zero road tax?

Owners of brand new cars that produce 0 grams of CO2 emissions, and have a list price of less than £40,000, don't pay any Vehicle Excise Duty. Owners of a car first registered between 1 March 2001 and before 1 April 2017 that produces up to 100 grams of CO2 per kilometre driven don't pay it either.

If you have a disability, you might be entitled to free car tax if you have an invalid carriage, such as a mobility scooter, receive War Pensioners' Mobility Supplement or receive the Enhanced Mobility Component of Personal Independence Payment.

The government will ban the sale of petrol and diesel vehicles by the end of this decade, with measures already in place to drive up the switch to electric. I

By the end of this decade, the government will ban the sale of petrol and diesel vehicles, with measures already in place to drive up the switch to electric. A renewable, filtered fuel called E10 will replace the current standard for unleaded petrol on September 1, and drivers are being offered case to trade in their old, 'dirty' vehicles